#185

Theme: This blog will explore the limitations of audits in uncovering major violations and ethical lapses. It will discuss the different types of audits (safety, finance, ethics, HR, operations) and how their focus on compliance can sometimes miss the bigger picture. We’ll delve into real-world examples like the Bhopal disaster to illustrate this point, and propose alternative approaches to strengthen organizational risk management.

Introduction

Imagine a world where every corporate scandal, safety violation, and financial collapse could have been prevented. According to a study by the Association of Certified Fraud Examiners, organizations lose an estimated 5% of their revenue to fraud each year, often undetected until it’s too late. This stark statistic highlights a crucial issue: why do audits frequently miss these critical red flags?

Audits are designed to ensure compliance and identify potential risks across various domains, including safety, finance, ethics, human resources, and operations. Yet, time and again, we witness catastrophic events and major violations that slip through the cracks, despite extensive auditing.

+++++++++

The Compliance Charade: Unveiling the True Focus of Audits

At first glance, audits appear to be the vigilant watchdogs of corporate integrity, meticulously scrutinizing every aspect of organizational operations to ensure compliance with regulations and internal controls. However, beneath this facade lies a stark reality: auditors are not investigators, but rather guardians of compliance, often constrained by the information provided by the very entities they are meant to scrutinize.

Audits: Guardians of Compliance

The primary mission of audits is clear-cut: to assess whether organizations adhere to established regulations, internal policies, and industry standards. Whether it’s ensuring workplace safety protocols are followed, financial transactions are accurately recorded, or ethical guidelines are upheld, audits play a vital role in maintaining order and accountability within corporate environments.

Auditors: Bound by Documentation

Auditors, though equipped with expertise and experience, are not detectives tasked with uncovering hidden truths. Instead, they rely heavily on the documentation and data provided by the organization under review. This reliance on provided information forms the cornerstone of audits, shaping the depth and breadth of their assessments.

The Limitations of Documentation

While documentation serves as the bedrock of audits, its reliability is not guaranteed. Organizations may present sanitized or incomplete records, obscuring potential red flags from auditors’ view. Moreover, audits are often conducted within predefined scopes, leaving certain areas unchecked or underexamined.

Auditors as Compliance Gatekeepers

In essence, auditors act as gatekeepers of compliance, diligently reviewing the documentation presented to them within the confines of their designated scope. While they possess the expertise to identify irregularities and deviations, their role is not to delve deep into investigative inquiries but rather to assess adherence to prescribed standards.

++++++++

The Auditor’s Argument: Defending the Role and Scope of Audits

Auditors often find themselves at the forefront of scrutiny, defending their practices and methodologies in the face of criticism and skepticism. One common refrain echoes loudly: “We are not lawyers. Compliance is the responsibility of organizations. We are not investigators.” Let’s unpack this argument and explore the rationale behind it.

Compliance: A Corporate Imperative

At its core, the argument posits that ensuring compliance with laws, regulations, and internal controls is fundamentally the responsibility of organizations themselves. Auditors contend that their role is not to act as enforcers or legal experts, but rather to assess and verify the organization’s adherence to established standards.

Auditors vs. Investigators

Drawing a clear distinction, auditors assert that their primary function is not to conduct investigative inquiries akin to law enforcement agencies. While investigators delve deep into uncovering wrongdoing and gathering evidence, auditors operate within a framework of predefined procedures and standards.

Reliance on Organizational Oversight

Auditors emphasize their reliance on the internal controls and documentation provided by organizations. They argue that their assessments are based on the information made available to them, and they cannot be held accountable for information that is withheld or misrepresented.

The Scope of Audits

Furthermore, auditors stress the importance of understanding the limitations of audits. While they possess expertise in identifying irregularities and deviations, audits are often conducted within predefined scopes and timelines, leaving certain areas unexplored or underexamined.

+++++++

Types of Audits and Their Shortcomings: Unveiling the Blind Spots

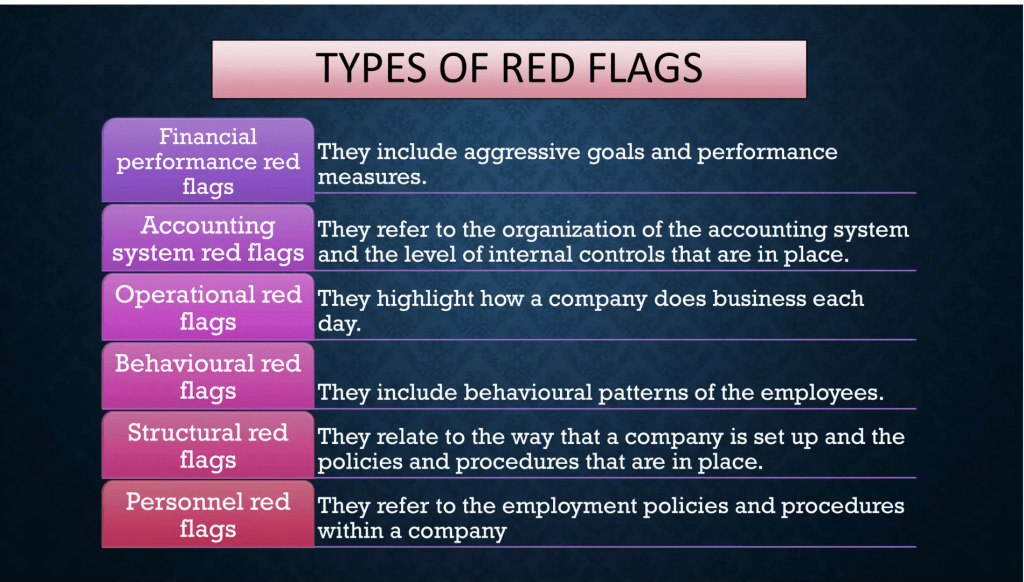

Audits serve as essential tools for assessing compliance and mitigating risks across various domains within organizations. However, despite their importance, different types of audits possess inherent shortcomings that can leave critical issues unaddressed. Let’s delve into the limitations of safety audits, financial audits, HR audits, and operations audits, shedding light on the blind spots they may fail to uncover.

Safety Audits: Overlooking Cultural Dynamics

Safety audits are designed to evaluate adherence to safety protocols and identify potential hazards in the workplace. However, they may fall short in capturing underlying cultural issues that prioritize production over safety. In environments where productivity reigns supreme, employees may feel pressured to cut corners or bypass safety measures to meet deadlines, leading to increased accident rates. Safety audits, focused primarily on procedural compliance, may fail to detect these cultural dynamics, leaving organizations vulnerable to preventable accidents and injuries.

Financial Audits: Limited to Surface-Level Assessments

Financial audits primarily focus on reviewing financial statements and ensuring compliance with accounting standards. While they provide valuable insights into an organization’s financial health, they may overlook intentional manipulation or ethical lapses in financial dealings. Sophisticated fraud schemes, such as creative accounting techniques or collusion among stakeholders, can go undetected without thorough investigative inquiries. Financial audits, constrained by their scope and reliance on provided information, may miss these red flags, exposing organizations to financial risks and reputational damage.

HR Audits: Blind to Hidden Workplace Dynamics

HR audits aim to assess compliance with employment laws and internal HR policies, focusing on aspects such as recruitment, training, and performance management. However, they may fail to uncover discriminatory practices or a toxic work environment that isn’t readily apparent from employee files. Subtle forms of discrimination, biased decision-making, or pervasive workplace culture issues may go unnoticed, perpetuating systemic inequalities and eroding employee morale. HR audits, constrained by their reliance on documented processes, may overlook these hidden workplace dynamics, hindering efforts to foster a diverse and inclusive organizational culture.

Operations Audits: Missing Ethical and Environmental Concerns

Operations audits are conducted to evaluate the efficiency and effectiveness of operational processes within organizations. While they aim to identify areas for improvement and cost-saving opportunities, they may miss ethical sourcing practices or environmental concerns hidden within routine procedures. Supply chain complexities, subcontractor relationships, and global sourcing practices can introduce risks related to labor rights violations, environmental degradation, or unethical business practices. Operations audits, focused on performance metrics and operational efficiency, may fail to delve deep enough to uncover these hidden risks, leaving organizations exposed to ethical and reputational challenges.

Summary: Addressing the Blind Spots

While audits play a crucial role in maintaining compliance and mitigating risks, they are not immune to shortcomings. Safety audits, financial audits, HR audits, and operations audits each possess inherent limitations that can leave critical issues unaddressed. To overcome these blind spots, organizations must adopt a holistic approach to auditing, incorporating qualitative assessments, cultural evaluations, and proactive risk management strategies. By recognizing the complexities of organizational dynamics and embracing a culture of transparency and accountability, organizations can enhance the effectiveness of audits and safeguard against potential risks and liabilities.

+++++

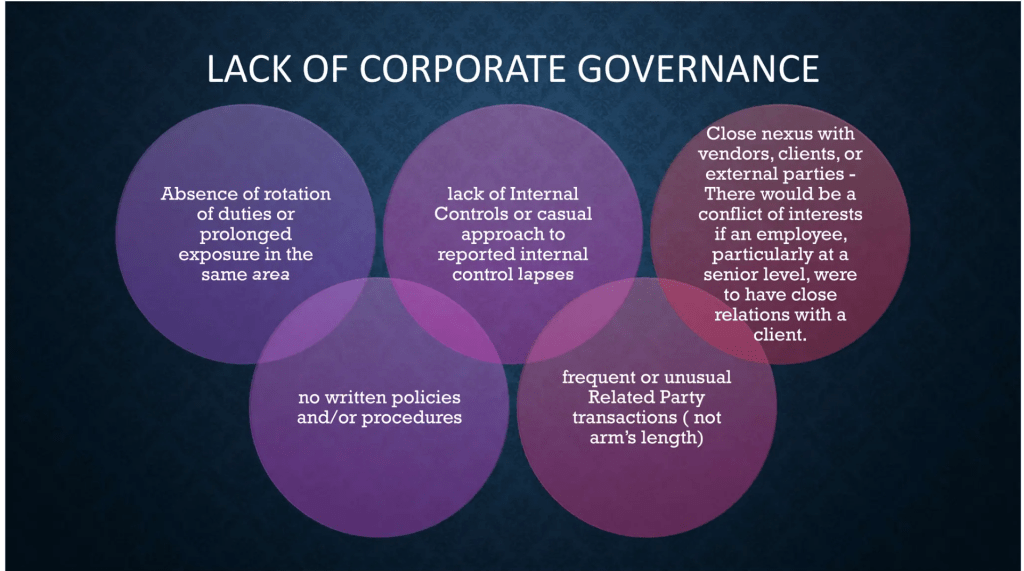

Organizational Culture and Auditor Independence: Navigating Complex Dynamics

Organizational culture plays a pivotal role in shaping the effectiveness and integrity of audits. The influence of corporate culture extends far beyond surface-level policies and procedures, permeating every aspect of organizational behavior and decision-making. Let’s explore how corporate culture can impact auditor independence and objectivity, shedding light on the complexities that auditors face in navigating these dynamics.

Influence of Corporate Culture

A Culture of Silence: In organizations where whistleblowing is discouraged or met with retaliation, critical issues may remain concealed beneath a veneer of secrecy. Employees, fearing repercussions, may hesitate to report violations or raise concerns, perpetuating a culture of silence that shields wrongdoing from scrutiny.

Profit Over Compliance: When profit becomes the primary driver of decision-making, ethical considerations and compliance obligations may take a backseat. In pursuit of financial gains, organizations may prioritize short-term gains over long-term sustainability, risking ethical lapses and regulatory violations.

Auditor Resistance: Auditors operating within such environments may encounter resistance or pushback when attempting to uncover potential violations. Stakeholders, driven by profit motives or vested interests, may seek to downplay or dismiss audit findings that threaten organizational objectives or reputations.

Independence and Objectivity

Compromised Independence: The independence of auditors is paramount to ensuring impartial assessments and unbiased reporting. However, when auditors are hired directly by the organizations they are auditing, conflicts of interest can arise, compromising their independence. The fear of jeopardizing future contracts or straining client relationships may influence auditors to temper their findings or soften their conclusions.

Biased Reporting: In cases where conflicts of interest exist, auditors may succumb to pressure to produce reports that favor the audited entity. Biased reporting undermines the credibility of audits and erodes trust in their findings, ultimately diminishing their effectiveness as mechanisms for accountability.

Navigating Complex Dynamics

In navigating the complex dynamics of organizational culture and auditor independence, vigilance and integrity are paramount. Auditors must remain steadfast in their commitment to upholding professional standards and ethical principles, even in the face of adversity. Organizations, likewise, must cultivate cultures of transparency and accountability, fostering environments where auditors can operate with independence and objectivity.

By promoting a culture that values integrity over expediency and accountability over profit, organizations can fortify the foundations of corporate governance and enhance the efficacy of audits as instruments for risk mitigation and compliance assurance. Ultimately, the symbiotic relationship between organizational culture and auditor independence underscores the critical importance of fostering ethical leadership and cultivating a culture of integrity at every level of the organization.

+++++++

Case Studies of Missed Red Flags in Audits: Lessons Learned

The Bhopal Gas Tragedy

Preventable Catastrophe: The Bhopal Gas Tragedy stands as a grim reminder of the catastrophic consequences of overlooked safety violations and inadequate risk management practices. Post-incident analyses revealed a litany of safety lapses, including poorly maintained equipment, inadequate emergency response protocols, and insufficient employee training.

Auditor Oversight: Shockingly, these critical issues were not identified or addressed in previous audits, highlighting significant shortcomings in the auditing process. Auditors, focused primarily on procedural compliance, failed to recognize the systemic deficiencies that ultimately led to one of the world’s worst industrial disasters.

Financial Collapses: Enron and Lehman Brothers

Illusion of Stability: The collapse of Enron and Lehman Brothers shook the financial world to its core, exposing the inherent vulnerabilities of even the most seemingly robust institutions. Despite undergoing extensive financial audits, both companies engaged in fraudulent practices and deceptive accounting techniques to mask their true financial health.

Auditor Blind Spots: Financial audits, primarily focused on reviewing financial statements and ensuring compliance with accounting standards, failed to uncover the deliberate manipulation and ethical lapses that precipitated these collapses. Auditors, constrained by their reliance on provided information and predetermined procedures, overlooked red flags that foreshadowed impending disaster.

Ethical Violations in Tech Companies

Tech Giants Under Scrutiny: Major tech companies have come under fire in recent years for a litany of ethical violations, including data privacy breaches and unethical labor practices. Despite undergoing HR and ethics audits, these companies have been accused of disregarding employee rights, fostering toxic work environments, and prioritizing profit over ethical considerations.

Auditing Blindness: HR and ethics audits, focused on assessing compliance with employment laws and internal policies, may fail to detect subtle forms of discrimination, biased decision-making, or pervasive workplace culture issues. Auditors, confined to reviewing documented processes, may overlook the nuanced dynamics that contribute to ethical lapses and employee discontent.

++++++++

The Argument for Enhanced Auditing Practices: A Call for Evolution

In today’s dynamic and interconnected business landscape, traditional auditing practices may fall short in identifying emerging risks and preventing potential crises. To adapt to this evolving environment, auditors advocate for enhanced auditing practices that prioritize integration, proactive risk assessment, technological innovation, and continuous learning. Let’s delve deeper into each aspect, supported by relevant examples that highlight the need for change.

Integrated Auditing Approach

Example: Financial Impact on Safety Protocols Consider a manufacturing company where financial decisions, such as budget cuts or resource reallocations, directly impact safety protocols. A traditional audit may focus solely on financial statements or safety procedures in isolation, overlooking the interconnectedness between the two domains. An integrated auditing approach would recognize the implications of financial decisions on safety practices, prompting auditors to assess the potential risks and mitigate them proactively.

Proactive Risk Assessment

Example: Supply Chain Vulnerabilities In an era of global supply chains and geopolitical uncertainties, organizations face heightened risks related to supplier integrity, geopolitical instability, and natural disasters. Instead of solely relying on compliance checks, auditors should employ proactive risk assessment techniques to identify vulnerabilities before they escalate into crises. For instance, by conducting scenario analysis and stress testing, auditors can anticipate supply chain disruptions and develop contingency plans to mitigate their impact.

Leveraging Technology

Example: Data Analytics for Fraud Detection The exponential growth of data presents both challenges and opportunities for auditors. Traditional audit methods may struggle to analyze vast datasets and detect patterns indicative of fraud or misconduct. By leveraging advanced technologies such as data analytics, AI, and machine learning, auditors can sift through massive volumes of data, identify anomalies, and uncover potential red flags. For example, using predictive analytics, auditors can detect irregularities in financial transactions or employee behavior that may indicate fraudulent activities.

Harnessing the Power of Data: Data analytics can provide invaluable insights into potential risks and vulnerabilities within an organization. By analyzing large datasets from various sources, including financial transactions, operational metrics, and employee behavior, organizations can identify patterns indicative of potential red flags and take proactive measures to mitigate risks.

Example: A retail company utilizes data analytics to identify patterns of fraudulent transactions or suspicious customer behavior. By analyzing sales data and customer interactions in real-time, the organization can flag potential instances of fraud and take immediate action to prevent losses.

Enhanced Training and Continuous Learning

Example: Regulatory Changes in Healthcare The regulatory landscape is constantly evolving, with new laws, standards, and compliance requirements being introduced regularly. Auditors must receive ongoing training to stay updated on these changes and adapt their auditing practices accordingly. For instance, in the healthcare sector, auditors must stay abreast of changes in healthcare regulations, privacy laws, and reimbursement policies to ensure compliance and mitigate risks of non-compliance penalties or legal liabilities.

+++++++++

Beyond the Checklist: Strengthening Risk Management for Risk-Based Auditing

In the realm of risk-based auditing, traditional approaches often fall short in identifying and addressing emerging risks and potential violations. To enhance risk management practices and effectively identify red flags, violations, and non-compliance, organizations can adopt alternative approaches that prioritize fostering a speak-up culture, leveraging data-driven risk assessments, (Covered above) and embracing continuous improvement and proactive measures.

Encouraging a Speak-Up Culture

Fostering Transparency and Trust: Cultivating a speak-up culture is essential for empowering employees to report concerns or potential violations without fear of retaliation. Organizations must demonstrate a commitment to transparency, actively listen to employee feedback, and ensure confidentiality and protection for whistleblowers.

Example: A manufacturing company establishes anonymous reporting channels and conducts regular employee engagement surveys to gauge perceptions of safety and compliance. By actively encouraging open communication and addressing concerns promptly and impartially, the organization fosters a culture of accountability and integrity.

Continuous Improvement and Proactive Measures

Iterative Risk Management Processes: Effective risk management requires ongoing assessment and proactive implementation of preventative controls. Organizations must continually evaluate their risk landscape, identify emerging threats, and implement measures to mitigate risks before they escalate into crises.

Example: A healthcare provider conducts regular risk assessments to identify potential vulnerabilities in patient data security and compliance with healthcare regulations. By proactively implementing encryption protocols, access controls, and employee training programs, the organization strengthens its data security posture and reduces the risk of data breaches.

_________________

Conclusion: Advancing Risk Management Beyond Audits

In the realm of risk management, audits serve as invaluable tools for assessing compliance and mitigating risks. However, it’s crucial to recognize that audits alone are not foolproof and may have limitations in identifying emerging risks, red flags, and potential violations. To effectively manage risks and promote organizational integrity, a multi-pronged approach is essential, one that goes beyond mere compliance and embraces proactive measures to address ethical concerns and foster a culture of accountability.

While audits provide a structured framework for assessing compliance with regulations and internal controls, they must be complemented by alternative approaches that prioritize transparency, data-driven insights, and continuous improvement. Fostering a speak-up culture empowers employees to report concerns without fear of retaliation, while leveraging data analytics enables organizations to identify potential red flags and areas of heightened risk. Additionally, embracing continuous improvement and proactive measures ensures that risks are identified and addressed before they escalate into crises.

As organizations navigate the complexities of risk management, it’s imperative to prioritize ethical behavior alongside adherence to established regulations. By fostering a culture of integrity, transparency, and accountability, organizations can strengthen their resilience and safeguard against risks that threaten their reputation and long-term success.

Call to Action: Prioritize Ethical Behavior in Risk Management

I urge organizations to embrace a holistic approach to risk management, one that transcends traditional audit practices and encompasses a commitment to ethical behavior. Let us prioritize integrity and transparency in our actions, empower employees to speak up against wrongdoing, and proactively address risks that may compromise our values and principles. Together, let us forge a path towards a future where ethical conduct is not only a regulatory requirement but a fundamental aspect of organizational culture.

Karthik

23/5/24 1pm.

Here’s a list of famous red flags missed by audits across various domains:

Safety:

- Dupont Incidents (La Porte, TX): Audits failed to address safety lapses and inadequate risk management practices at Dupont’s La Porte, Texas facility, where multiple incidents, including a deadly methyl mercaptan release in 2014, highlighted longstanding safety deficiencies.

- Deepwater Horizon Oil Spill (2010): Audits overlooked safety lapses and equipment failures on the Deepwater Horizon drilling rig, resulting in the largest marine oil spill in history.

- Belle, West Virginia Phosgene Gas Fatality: In 2010, an employee at the now Chemours plant in Belle, West Virginia, died after exposure to phosgene gas, highlighting serious safety lapses and inadequate risk management practices. Audits failed to identify and address the potential hazards associated with the handling of hazardous chemicals, leading to tragic consequences.

Financial:

- Enron Collapse (2001): Auditors failed to detect fraudulent accounting practices and off-balance-sheet liabilities, leading to the collapse of Enron, one of the largest corporate bankruptcies in history.

- WorldCom Accounting Scandal (2002): Audits missed accounting irregularities and inflated earnings at telecommunications giant WorldCom, resulting in one of the largest accounting scandals in U.S. history.

Social/Ethical:

- Wells Fargo Fake Accounts Scandal (2016): Audits failed to uncover the widespread practice of opening unauthorized accounts at Wells Fargo, highlighting ethical lapses in the banking industry.

- Rana Plaza Collapse (2013): Audits overlooked unsafe working conditions in garment factories, leading to the collapse of the Rana Plaza building in Bangladesh and the deaths of over 1,100 workers.

Supply Chain:

- Nike Sweatshop Controversy: Audits failed to address labor abuses and poor working conditions in Nike’s overseas factories, sparking a public outcry and damaging the company’s reputation.

- Foxconn Suicides: Audits missed warning signs of poor labor conditions at Foxconn factories in China, where a series of worker suicides occurred, drawing attention to supply chain labor practices in the technology industry.

Health:

- Theranos Scandal: Audits overlooked fraudulent practices at Theranos, a healthcare technology company, which claimed to have developed revolutionary blood testing technology but was found to have misled investors and regulators about the capabilities of its products.

- Tobacco Industry Deception: Audits failed to uncover the tobacco industry’s decades-long campaign of deception regarding the health risks of smoking, highlighting the need for greater scrutiny of health-related claims in corporate practices.

These examples illustrate the critical importance of thorough audits and the potential consequences of overlooking red flags in various domains.