#251

Risk assessment is the backbone of Business excellence, workplace safety, operational excellence, and business continuity. It serves as a critical tool in identifying, quantifying, and mitigating risks across various domains—safety, quality, productivity, finance, people management, and retention. Despite its significance, risk assessment often fails to deliver value due to systemic flaws, poor execution, and lack of organizational commitment. In this blog, we explore the key reasons why risk assessments fail and how organizations can leverage them effectively to enhance business resilience.

Why Risk Assessments Fail?

1. Incomplete Coverage of Activities

One of the most common reasons risk assessments fail is the poor overview of activities covered. Many critical operations and potential hazards are either overlooked or ignored. This leads to an incomplete risk profile, making the assessment ineffective in real-world scenarios.

2. Single-Point Failure: The Checklist Approach

Many organizations treat risk assessments as a mere compliance exercise—a ‘check-in-the-box’ activity. Instead of engaging all relevant stakeholders through brainstorming sessions and collaborative evaluation, a single person or department handles it in isolation. This leads to a lack of diverse perspectives, resulting in superficial risk identification.

3. Poor Risk Prioritization Due to Inadequate Metrics

Factors such as frequency of occurrence, number of people impacted, and exposure duration are often not systematically analyzed. Without proper weightage, risk profiles become too dense, making it difficult to identify the key issues that require immediate attention.

4. Failure to Assess Full Impact of Risks

Many risk assessments fail to comprehensively evaluate the consequences of a risk. As a result, when an incident occurs, organizations are caught off guard by unforeseen impacts that were either underestimated or completely left out of the assessment.

5. Oversimplification of Risks

Organizations sometimes oversimplify risk scenarios, leading to a failure in appreciating the true severity of consequences. A minor risk on paper might escalate into a catastrophic event due to interdependencies or secondary failures that were never considered.

6. Lack of Accountability and Ownership

Even when risks are identified and mitigation strategies are proposed, their execution often fails due to a lack of clear ownership. If no one is held accountable for risk mitigation, the entire process loses its effectiveness, leaving organizations vulnerable to foreseeable threats.

7. Weak Leadership Commitment

Risk assessments require leadership buy-in at every level. Without active engagement, accountability, and traction from leadership, the assessment remains a paper exercise with no real implementation or follow-through.

8. Poor Data Management and Incorrect Risk Estimation

Risk assessments rely heavily on data, but when organizations lack structured data collection and analysis, risk estimations become inaccurate. This results in either underestimating or overestimating risks, leading to poor decision-making.

9. Lack of Integration with Business Objectives and Strategy

Risk assessments should align with an organization’s strategic vision and business objectives. Unfortunately, many organizations conduct risk assessments in isolation, without linking them to financial planning, growth strategies, or operational priorities. This disconnect reduces the value of the exercise.

How Organizations Can Improve Risk Assessments for Real Value Capture

1. Adopt a Holistic and Comprehensive Approach

Risk assessments must cover all aspects of business operations, including safety, quality, productivity, financial risks, and workforce management. Organizations must ensure that all key activities and processes are accounted for.

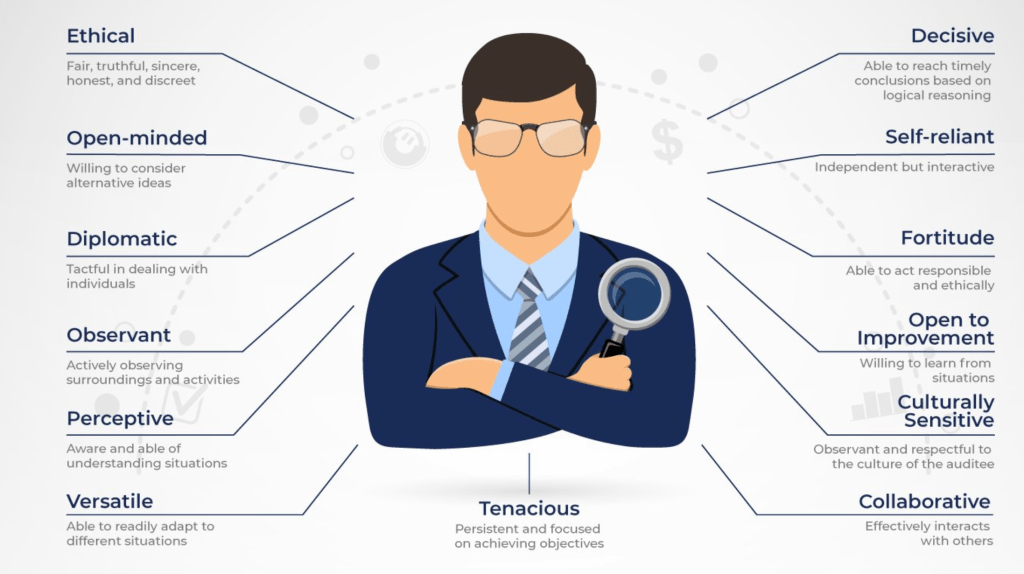

2. Foster a Collaborative Risk Assessment Culture

Risk assessments should involve a multidisciplinary team, including frontline workers, middle management, and leadership. This ensures diverse insights and a comprehensive evaluation of potential risks.

3. Implement a Robust Risk Prioritization Framework

A structured framework using risk matrices, frequency analysis, and impact assessment should be deployed to identify critical risks that require immediate attention.

4. Conduct Scenario Planning and Impact Analysis

Organizations should conduct ‘what-if’ scenario planning to fully understand potential impacts. This helps in proactive planning rather than reactive crisis management.

5. Strengthen Accountability Mechanisms

Assign clear ownership of risk mitigation actions, with timelines, review mechanisms, and performance indicators. Risk ownership should be embedded into employee KPIs and leadership accountability metrics.

6. Ensure Leadership Commitment and Active Engagement

Senior management must be actively involved in risk assessment discussions and decision-making. Leadership buy-in ensures that risk management is integrated into business processes and not seen as an isolated compliance function.

7. Leverage Data-Driven Risk Assessment Models

Utilizing technology, data analytics, and AI-driven predictive risk assessment tools can enhance accuracy, reduce human bias, and provide real-time risk insights.

8. Link Risk Assessment to Business Strategy

Risk management should be embedded into strategic planning, business continuity frameworks, and financial risk modeling to ensure holistic organizational resilience.

Case Studies: Success and Failure Stories

Success Story: Toyota’s Integrated Risk Management System

Toyota’s risk assessment framework is seamlessly integrated into its quality management and production system. By leveraging data analytics and employee feedback, Toyota proactively identifies risks, mitigates issues before they escalate, and ensures continuous improvement. Their risk management approach contributed significantly to their reputation for operational excellence and product reliability.

Failure Story: BP Deepwater Horizon Disaster (2010)

The Deepwater Horizon oil spill was a textbook case of risk assessment failure. Despite multiple warnings and red flags, BP and its contractors failed to assess the full impact of well pressure anomalies and safety system malfunctions. The lack of accountability, leadership commitment, and prioritization of safety risks over financial considerations led to one of the worst environmental disasters in history.

Parting thoughts:-

Risk assessment, when done right, is a powerful tool for workplace safety, operational efficiency, and business sustainability. However, when treated as a ‘paper tiger’ or compliance burden, it fails to deliver meaningful results. Organizations must shift from a ‘checklist mentality’ to a strategic, data-driven, and accountable risk management approach. By fostering a culture of risk awareness, leadership engagement, and structured execution, companies can turn risk assessments into a competitive advantage rather than a regulatory obligation.

With risk now being a key component in standards like ISO 9001 (Quality), ISO 14001 (Environment), ISO 45001 (Health & Safety), and ISO 50001 (Energy Management), organizations must go beyond paperwork compliance to truly leverage risk assessment for business excellence.

What has been your experience with risk assessments? Have you seen it work effectively, or has it been just another documentation exercise in your organization? Share your thoughts!

Karthik

1st March 2025

11am.